A place for connecting economic news and theory to the practice of teaching economics

Wednesday, November 9, 2011

BBC Video on the Euro and Crisis

Short little informative video from th BBC about the Euro and the current crisis.

Thursday, October 27, 2011

Daniel Kahneman on Confidence

Daniel Kahneman, 2002 Nobel Prize winner, is out with a new book and it is excerpted in the New York Times - this could be a good read for students in a unit on behavioral economics. Also, in the New York Times in a interview with Kahneman from when he won the prize.

Greek Deal - How the Contagion Could Spread

Well, it looks like Europe got its act together at the last minute and put off the ugly end to the Greek crisis - at least for now. Although, the details that make up the deal have yet to be released or have opened up a new bag of questions. Below is a good graphic from the New York Times shows how the Greek crisis could affect the world - good teaching tool.

Monday, October 10, 2011

Recession is Over - Incomes Going Down

The New York Times has a good article on how average incomes have gone down in the aftermath of the recession. This is one of the reasons why "it still feels like a recession". It also means that it will be a slow recovery (since low incomes will result in lower consumption). The graph below says it all.

Sunday, October 9, 2011

Projection of Time Until Full Employment

The graph below shows the different projections of how long it will take to return to full employment under different amount of monthly job creation. As Mark Thoma said, "no need to hold on to your hats, it looks like it will be a slow ride."

Multiple Equilibria in Crisis

Greg Ip has a good post reporting on the idea that in a currency crisis (or other similar crisis) there can be multiple point of equilibria. As he says:

Courtesy of the Bank Credit Analyst, it nicely illustrates the dilemma facing euro zone peripheral sovereigns. In normal times (upper part of the chart), demand for Italian bonds is downward sloping. As prices fall (yields rise), demand rises. But at a certain point, higher yields call into question Italy’s solvency, and demand actually falls. In this zone of vulnerability, the demand curve is upward sloping. Only once Italian bond prices fall into distressed territory, presumably at much lower deficits and levels of GDP, does the curve resume its normal shape.

The BCA writes:

The possibility of speculative attacks blurs the distinction between liquidity and solvency. As a result, there may not be any single unique “equilibrium” for debt yields. Rather, debt markets may be subject to multiple equilibria … In such an environment, shifts in financing costs can lead to a wide variation in the possible trajectories of debt-to-GDP ratios over time, which serves to exacerbate market anxiety. Faced with such multiple equilibria, it is a central bank’s responsibility to ensure that the “good” (i.e. low yield) equilibrium is reached. The fact that the ECB has yet to grasp this lesson is bewildering.

Courtesy of the Bank Credit Analyst, it nicely illustrates the dilemma facing euro zone peripheral sovereigns. In normal times (upper part of the chart), demand for Italian bonds is downward sloping. As prices fall (yields rise), demand rises. But at a certain point, higher yields call into question Italy’s solvency, and demand actually falls. In this zone of vulnerability, the demand curve is upward sloping. Only once Italian bond prices fall into distressed territory, presumably at much lower deficits and levels of GDP, does the curve resume its normal shape.

The BCA writes:

The possibility of speculative attacks blurs the distinction between liquidity and solvency. As a result, there may not be any single unique “equilibrium” for debt yields. Rather, debt markets may be subject to multiple equilibria … In such an environment, shifts in financing costs can lead to a wide variation in the possible trajectories of debt-to-GDP ratios over time, which serves to exacerbate market anxiety. Faced with such multiple equilibria, it is a central bank’s responsibility to ensure that the “good” (i.e. low yield) equilibrium is reached. The fact that the ECB has yet to grasp this lesson is bewildering.

Comparing the Great Depression to Now - How Now is Worse

David Leonhardt has a good piece comparing the Great Depression to the current economic problems in terms of how the shadow of the Depression American industry was building the base for the economic growth in subsequent decades. He notes that this does not seem to be happening now. His basic point of how were have a cyclical downturn built on a structural growth downturn is a troubling idea. The article also has this good graph of job creation looking back over sixty years.

Labels:

david leonhardt,

economic growth,

Great Recession

Saturday, October 8, 2011

Bernanke on the Couch

The New York Times Dealbook blog has a video clip of Bernanke on his psychiatrist's couch.

Robert Solow on Nasar's "Grand Pursuit"

Robert Solow casts a critical eye on Sylvia Nasar's book of economic history, The Grand Pursuit, and points out its short falls in explaining the economic ideas in economic history.

Monday, September 26, 2011

Unemployment Across the Unites States

The New York Times has a good graphic of how unemployment over the course of the recession until now has affected different parts of the United States. The geography of the on going economic problems should spark some debates. Here it is:

Saturday, September 24, 2011

Eurozone Public and Private Debt

Floyd Norris in the New York Times has a good article comparing the levels of public and private debt in eurozone countries. The article makes the point that the amount of private debts in these countries is important in the current crisis because it directly affects the ability of these counties to grow their economies (which is harder if the population is trying to dig itself out from a pile of debt). The article also has this good chart:

Tuesday, September 20, 2011

Greek-Euro Crisis

Greece is heading for a crisis point (again). As always, it looks like the big crisis point, but we shall see if the Europeans come up with another way of kicking the can down the road. The New York Times has a good graphic (shown below) that explains the basics of the crisis.

Sunday, September 18, 2011

Marketplace Comic Book on the Fiancial Crisis

Marketplace has posted a comic book about the economic crisis in 2008. Looks good. Below is the intdroduction by Paddy Hirsh (of Whiteboard Video fame).

WHITEBOARD SPECIAL: Lehman Brothers, three years on from Marketplace on Vimeo.

WHITEBOARD SPECIAL: Lehman Brothers, three years on from Marketplace on Vimeo.

Labels:

Economic crisis,

marketplace,

Paddy Hirsh,

Whiteboard

Goldman Sachs Chart on Obama's Job Plan

The chart below is from Goldman Sachs and shows how different fiscal policies will affect the economy. Two thinkgs to note:

First, look at how the current spending will create a fiscal drag, pull down the economy - this is because of the large cutback state and local government spending (the American austerity policy).

Second, look at the effects created by Obama's plan - either hold constant or small stimulus.

First, look at how the current spending will create a fiscal drag, pull down the economy - this is because of the large cutback state and local government spending (the American austerity policy).

Second, look at the effects created by Obama's plan - either hold constant or small stimulus.

Monday, September 12, 2011

Nasar Cartoon on Economic History

Nasar on Fisher

Nasar has another article in Bloomberg in the run up to the release of her book. This one is on Fisher and his ideas - a too often overlooked economist.

Sunday, September 11, 2011

Nasar on Keynes and Schumpeter in 1919

Sylvia Nasar has a new book on the history of economic thought called Grand Pursuit: The Story of Economic Genius. It got a strong review in the Economist. In the run up to the release of the book, she has this article on Bloomberg about the roles of Keynes and Schumpeter in the wake of World War One with the restarting of economics. It is interesting how she portrays Schumpeter working to create a new economic Austria in the wake of the collapse of the Austro-Hungarian Empire and Keynes trying to get the Big Four to be less crushing on Germany.

Loss of Teaching Jobs - American Austerity

The chart below show the loss in teaching jobs over the course of the recession - around 300,000. Keep in mind that the population has been growing, which means a higher teacher to student ratio. This will have an adverse effect on American education. On a macro view, this is an example of the American austerity program. In total (Federal, State and local) government, spending has gone down over the past few years. This is because state and local governments cannot run deficits and so have to balance their budgets - which means job cuts. The United State's governments have been enacting an austerity package.

Zandi Thinks the Obama Plan Would Work

Mark Zandi has crunched the numbers for Obama's job's plan and concludes it would work - that it would add 2% to GDP and create 1.9 million jobs and reduce unemployment by 1%. That is the good news. Bad news - he doesn't see a lot of the program getting through congress. Here is the details of his analysis. The best part is the chart below.

Matching Jobless to Jobs on PBS News Hour

The PBS News Hour had a good video on the issue of structural unemployment - the problem that today's jobless may not match the jobs available. In short that structural unemployment is are current problem. As the video makes clear, this is currently a major point of debate.

Watch the full episode. See more PBS NewsHour.

Labels:

PBS News Hour,

Structural Unemployment,

Unemployment

Tuesday, September 6, 2011

Rich and Poor in Europe

Throughout the euro crisis the discussion has been around the rich and poor countries. However, that division is not quite honest. The reality of rich an poor in Europe is regional. The magazine Spiegel has posted a great map showing the income (based on GDP per capita) for the different regions of Europe.

Friday, September 2, 2011

How the Great Recession Measures Up

The new unemployment numbers are out and nothing has changed - which is bad. Unemployment is still at 9.1% with no new new jobs for August. Catherine Rampell in the New York Times Economix blog posted the following graph that shows this to be the longest and worst recession of the post-war period. Maybe we should follow Ken Rogoff and stop calling it a recession and instead call it the "Great Contraction".

Saturday, August 27, 2011

Peter Diamond on Fiscal Policy and Unemployment

Nobel Prize winner Peter Diamond has a video on the Economist web page about the fiscal policy situation and the on-going unemployment problem.

Sunday, August 21, 2011

Tyler Cowen on Productivity

If there is a reasonable voice on the free market side of the economics debate these days it is Tyler Cowen. His insights and ideas are where the Keynesian counter-balance should be - unfortunately it is not. He has a good piece in the New York Times on the declines in American productivity and what it could mean to the economy. Evidence that Cowen is a good counter-balance? How about the quote, "Keynesians argue that the economy is suffering from a lack of spending or too little "aggregate demand". That is a valid point, but...." How often do you hear that in economic debate these days?

Economics and Children's Stories

Motoko Rich of the New York Times has a good article about finding economics in children's stories.

Tuesday, August 16, 2011

Tyler Cowen on Stagnation

In an Economist Video - Tyler Cowen, who wrote "The Great Stagnation" on structural issues - such as firing bad teachers.

Rogoff - learning to like inflation

Ken Rogoff has come out strong in calling for higher inflation to get the economy moving. His thought is to move he target to 2-4%. Below is a video from the PBS Newshour where Rogoff is on a panel with Paul Krugman saying the same thing.

Watch the full episode. See more PBS NewsHour.

Bruce Bartlett - Its Aggregate Demand!

Bruce Bartlett has a post in the New York Times Economix blog about how the root of the current crisis is Aggregate Demand (The only news in this is that Bartlett use to work for Ron Paul, Jack Kemp and George Bush). Basically, he is calling for the Fed to increase the money supply - that inflation is the lesser of evils right now. However, the post does have some good number on money supply, velocity, and the relationship between asset prices and demand (wealth effect). Could be good to use with students.

Federal Revenues, Spending and Debt - Charts

Uwe Reinhardt has a post in the New York Times Economix blog about the Federal ratings downgrade that has some good charts on the comparisons of Federal revenue to deficits and about the size of the debt. Here they are:

Labels:

debt ceiling,

debt crisis,

Federal debt,

Reinhardt

Debts around the world

Speigel online has the following graphic of national debts around the world - good visual for getting students talking about debt size. Would be better if it had information about the size of GDP in each nation.

Wednesday, July 6, 2011

Less Money? - Well less dollar bills

The New York Times has an interesting article and graphic about the reduction in the printing of currency by the Treasury Department because of the increase use of credit cards, debit cards and on-line bill paying. Check out the graphic:

Thursday, June 30, 2011

Assessing Quantitative Easing

The Wall Street Journal has a good graphic assessing Quantitative Easing - basically it shows that QE did not accomplish very much in terms of stimulating the economy. I think this is a bit misleading since I do not think that was really the goal of the QE program. Basically, it was to prevent deflation and move investors away from safe haven of government bonds (by lessening the benefits of holding bonds). The argument that a liquidity trap makes monetary policy all but ineffective seems to hold up. So, while QE may not have gotten us out of the hole we are in, it did prevent deflation which would have made things worse - and that is the real measure of its success.

Here is the graph:

Here is the graph:

Wednesday, June 22, 2011

Interactive Economic History & Policy

The Big Picture has reposted a great New York Times interactive graphic from 2009 showing a history of the American economy from 1960 to 2009, policy actions during that time and descriptions from economists. Great teaching tool - hopefully they will update it. Check it out:

Tuesday, June 21, 2011

Bitcoin - New Currency?

A new on-line currency, the bitcoin, has been created and is in circulation. Basically, it is currency created through a computer algorithm that can be used for on-line purchases and is free from any national government. There is a lot of talk that it will become the currency of drug dealers and criminals. Newsweek has a short article on it here and the Economist blog has a larger post on it here.

I am not sure what will happen to this currency. I suspect not much. The amount to be put in to circulation will be small (21 million coins, even at a price of $18 per coin, is not much of a base for a currency). However, the bigger issue is whether this currency can offer anything (except hiding illegal activity) that most people would want in a currency that is not already available. I know that Internet people will say that this is a new form of currency - however, the idea of private entities creating their own currency is not a new idea. More importantly, the fixed amount of bitcoins will likely result in hoarding, hence raising its value - but leading to a form of deflation. Or, it could simply be too difficult to use and be utterly worthless. Either way, it will be interesting - although not very useful.

I am not sure what will happen to this currency. I suspect not much. The amount to be put in to circulation will be small (21 million coins, even at a price of $18 per coin, is not much of a base for a currency). However, the bigger issue is whether this currency can offer anything (except hiding illegal activity) that most people would want in a currency that is not already available. I know that Internet people will say that this is a new form of currency - however, the idea of private entities creating their own currency is not a new idea. More importantly, the fixed amount of bitcoins will likely result in hoarding, hence raising its value - but leading to a form of deflation. Or, it could simply be too difficult to use and be utterly worthless. Either way, it will be interesting - although not very useful.

Krugman on Keynes

For the 75th anniversary of the General Theory, Paul Krugman gave a good talk (called "Mr. Keynes and the Moderns") on how to read Keynes and how Keynes' ideas might be useful to policy makers now. It is available here and here.

Deadbeat Germany - Historically Yes!

The German online magazine Spiegel has a great article that should humble Germany's demands for Greek, Irish and Portuguese austerity. It makes the case that in the twentieth century, Germany was a major defaulter and depended on other countries absorbing its losses - i.e. taking "haircuts". It is a good historical perspective that shows that Germany does not have a financially righteous past - but is really a reformed sinner.

Sunday, June 19, 2011

Inflation Solution?

The Wall Street Journal has a good piece today on how a rise in inflation (it says 5%) would do a great deal get the economy up and running again. The basic idea is that it will destroy debt. The argument is not new - of very provocative - the surprise is the source.

Saturday, June 18, 2011

Interactive Euro Crisis Map

The New York Times has a good set of interactive maps of the Euro Crisis. The crisis seemed to be heading to some type of resolution this week until Germany changed its mind on forcing some of the losses on bond holders. Now it appears that bond holders will be protected and the crisis has been pushed down the road. However, the crisis is far from resolved - it price tag has just been pushed more on the European taxpayers. The big lingering question is when this crisis will explode. The maps are informative.

Average Income over Lifetime

The Wall Street Journal has the following graph showing average income over he course of a lifetime. The big point of the article and the graph is how income plateaus at age forty. This reality runs counter to how most people see their income growth over heir lifetimes (what would this mean for the idea of the "lifetime income hypothesis"?) The bigger point is that people's expectations of quickly rising incomes in their fifties might result in people underfunding their retirement plans.

Friday, June 10, 2011

GDP Growth since 1939

Wednesday, June 8, 2011

Charlie Rose Again - Grethen Morganson

Charlie Rose has another interview, this time with New York Times columnist Gretchen Morganson about the crisis. Should be good.

Half Way to a Lost Decade? Depends on How You Measure

Justin Wolfers on the Freakeconomics blog has a good post showing that if you measure GDP by income, instead of the more usual spending, the recession has been longer and deeper - and we still have not fully recovered. This explains more fully why people still say we are in recession when people in Washington tout that we have been in recovery for years. The two good charts from the post are:

Labels:

Freakonomics,

Justin Wolfers,

Length of Recession,

Measure GDP

FRBSF Ecnomics Letter - Education & Monetary Policy

John Williams, president of the San Fransisco Fed published a letter about how he thinks economics education needs to adapt the teaching of monetary policy to reflect the recent actions of the Fed.

Greek Problem - Good Charts

One of the big questions in the world economy right now is how long can the Europe crisis go on and when will it break. The German magazine Spiegel has the following charts showing the worsening condition for Greece - it does not look good.

The first chart shows clearly how debt growth is outpacing GDP growth (which is negative).

Clearly Greece is going down (unless the Germans want to permanently support them). One of the big unknown is the losses a Greek (and Irish and Portuguese) restructuring will do to European banks - will the debt crisis cause a European Lehman crisis. The balance sheet of the ECB is looking shaky, as shown in the chart below.

The first chart shows clearly how debt growth is outpacing GDP growth (which is negative).

Clearly Greece is going down (unless the Germans want to permanently support them). One of the big unknown is the losses a Greek (and Irish and Portuguese) restructuring will do to European banks - will the debt crisis cause a European Lehman crisis. The balance sheet of the ECB is looking shaky, as shown in the chart below.

Health Care - A International Comparison Chart

Charlie Rose - Krugman, Walker & Rogoff

Charlie Rose has interviews with Paul Krugman, David Walker and Ken Rogoff about the the current state of the economy: http://www.charlierose.com/view/interview/11710#schedule

Monday, May 30, 2011

Monetary Step Backward?

The New York Times has a good article about people in Utah pushing the state to adopt a law that would make it easier for people to buy things with gold and silver coins (based on the value of their weight). This is a Tea Party idea and it seems as if they want to push the idea of allowing states to coin their own money. There are a lot of ways to attack this, but it should be sufficient to say that the idea is a big step backwards and shows just how out of touch the Tea Partiers are with basic economics.

Tuesday, May 24, 2011

Christina Romer and the Strong Dollar

Christina Romer has a good piece in the New York Times Economic View column about the economics and politics of the dollar - basically, is a strong dollar a good thing? She does a good job explaining how currency markets set the value of the dollar and why having a strong dollar is more of a political issue than an economic concern. This is definitely a good article for students when discussing exchange rates.

Labels:

Christina Romer,

exchange rates,

strong dollar

Monday, May 16, 2011

Inflation on PBS Newshour

Paul Solman has a good piece on how inflation is measured and what inflation means in this video clip from the PBS Newshour.

Watch the full episode. See more PBS NewsHour.

Wednesday, May 11, 2011

Total Tax Burden Around the World

Four Workers for Every Job

Catherine Rampell covers this in the New York Times Economix blog. The improving job numbers makes everyone think that we are out of the woods in terms of the economy. How far we have to go to get back to normal is still a big number. An indication of this is the number of jobless workers for every employment vacancy (this does not get into whether or not the jobless workers are appropriately skilled for the vacant jobs). The new, and improved number is: four jobless workers for each opening - still not good odds. This graph show this and puts it into historic relevance.

Tuesday, May 10, 2011

Mankiw's Three Big Questions

Greg Mankiw in the New York Times Economic View column posts the three big questions that are currently perplexing him. They are:

1. How long will it take for the economy's wounds to heal?

2. How long will inflation expectations remain anchored?

3. How long will the bond market trust the United States?

These are good questions, and Mankiw's explanation of why the answers matter are good. If students can understand that these are the important questions to ask, they have learned a lot.

1. How long will it take for the economy's wounds to heal?

2. How long will inflation expectations remain anchored?

3. How long will the bond market trust the United States?

These are good questions, and Mankiw's explanation of why the answers matter are good. If students can understand that these are the important questions to ask, they have learned a lot.

Role of Economics?

Edward Glaeser made his last post to the New York Times Economix blog today and it is worth the read. Glaeser's post explains his view of the purpose and limits of economics in an imperfect world - and what economists can add to the public debate on issues. It is a good short read into the philosophy of economics.

Friday, April 22, 2011

Dani Rodrik's Parable of Trade

Dani Rodrik posted his parable of trade and an explanation on his web page - it is a short and simple reading that shows the benefits (and social costs) of trade. This will be on my reading list from here on.

Friday, April 15, 2011

Deficit Debate - Krugman vs. Holtz-Eakin

The PBS News Hour has a good debate about the deficit and debt debate between Paul Krugman and Douglas Holtz-Eakin.

Watch the full episode. See more PBS NewsHour.

Thursday, April 14, 2011

Why Can't Economists Agree on Deficit?

Mark Thoma has a good article in Fiscal Times about the reasons why economist disagree over the Federal deficit. As Thoma points out, and explains, the divide between economists is based on the classical-Keynes split.

Wednesday, April 13, 2011

Ryan and Obama Plans Side by Side

The New York Times has a good chart that lays out the differences between the Ryan and the Obama deficit reduction plans. Let the debate begin.

Debt Ceiling Video

Paul Solomon on the PBS News Hour has a good video about the issues involves in the debt ceiling debate, its effect on the economy and how it is viewed on Wall Street. It is very informative and good for teaching the concept.

Watch the full episode. See more PBS NewsHour.

Sunday, April 10, 2011

Structural vs Cyclical Unemployment Debate

Christina Romer has a good column in the New York Times on the current debate over the rise in the natural rate of unemployment and whether the current unemployment problem is cyclical or structural. Romer does a good job showing that most of the current unemployment problem is the result of cyclical issues and not structural (mismatch of job creation to the skills of the unemployed or a "housing lock" of people tied to underwater mortgages). However, she also makes the case for why the government should be concerned with increases in structural unemployment.

Labels:

Christina Romer,

Cyclical unemployment,

NAIRU,

natural rate of unemployment,

Structural Unemployment

Debate over the Debt Ceiling

Now that the current budget debate is over, the next debate will be over raising the debt ceiling. This debate will be coming to its :do or die" time over the next five weeks. This debate is more important. The temporary shutdown of the Federal government would have been not good, but the failure to raise the debt will be a big bad that could have wide ranging consequences for the U.S. and world economies. So, as this debate gets going, it is time to look at the current composition of the debt. The New York Times published this graphic showing the history of rising the debt ceiling and the composition of the current debt. Three points to look at on this. First, look at the amount owed to Social Security. Second, the amount added to the debt by the Obama stimulus plan. Third, the amount added by the various programs of George W. Bush. Interesting that only now the Republicans are worried about the debt - so much so that they will threaten the creditability of the U.S. on world financial markets.

markets.

Sunday, April 3, 2011

The Civil War and the Great Monetary Experiment

The blog Macro and Other Musings has a good post on the three monetary systems the United States used during the Civil War (Green bank fiat currency in the North, State backed fiat currency in the South and Gold back currency in California). The comparisons between the systems and effects on the war are interesting. Because, the value of Confederate money depended on the war situation, it value fluctuated during the war. The graph below show this:

Saturday, April 2, 2011

Fed - Central bank to the world

Gretchen Morgenson in the New York Times puts together the pieces to show how the Federal Reserve loaned hundreds of billions of dollars to European banks in the run up to the financial crisis. It is interesting how European banks turned to the Fed and not the ECB in this point of crisis.

Friday, April 1, 2011

Long Great Recession

Unemployment is down to 8.8% - that's good. How does this recession match up with post-war history? It is still the worst. Check out the chart below from the blog Calculated Risk (via the Economist's Free Exchange blog):

Cost of Living and Poverty Level

The New York Times has a good article about how much it costs to have a basic standard of living and how it compares to the Federal poverty level. Simply, the gap is huge. Considering 14% of Americans are at or below the Federal Poverty level, the percentage of those not able to have a basic standard of living is substantial. The chart below breaks down the difference between the two.

Wednesday, March 30, 2011

Inflation & Unemployment

David Leonhardt has a good column in today's New York Times about the sputtering economy - the slow sluggish jobless recovery. In it he has this good graph of unemployment and inflation that points to the reality that unemployment, not inflation, is the big problem in the economy.

Saturday, March 26, 2011

75 Years of American Finance: A Graphic Presentation 1861-1935

FRASER, the Federal Reserves Archival System for Research, has a great old time graphical presentation of American Finance done in 1936. It is basically a really complex timeline of historical events that effect American history. It is the kind of thing that could suck up hours of reading. Below is a snap shot image.

Tuesday, March 22, 2011

Economic Growth and Life Expectancy

David Leonhardt in the New York Times has a great article about the nuances of economic growth - specifically the improvement of life expectancy and economic growth. He notes that while Africa is still far behind the rest of the world, it is getting better. The article also had this great graphic showing GDP per capita growth and improvements in life expectancy.

Monday, March 21, 2011

Cleveland Fed's Interactive Balance Sheet

Here is a great teaching tool from the Cleveland Fed that shows all of the balance sheet tools the Fed has used in addressing the economic crisis. Check it out.

Labels:

Cleveland Fed,

Feb balance sheet,

Fed policy tools

Friday, March 11, 2011

Blindspots on Left and Right

David Leonhardt has a good post in the New York Times Economix blog comparing the economic blind spots of non-economist liberals and conservatives. It is an interesting list and could be useful in opening discussions with students about economics and politics.

Monday, March 7, 2011

Best Economics Blogs

Time Magazine has published a list of the best economics blogs. It is a good list. I follow many of these blogs, but alas do not have time for all of them. Anybody wishing to stay on top of economics thinking should follow as many of these as possible (On a side note, the blog "Economist's View" has a good summary of the posts on many of these blogs and can be a good jumping off point to these other blogs). The Time Magazine list also has a good description of each of the 25 blogs it lists.

Tuesday, February 22, 2011

When will the Fed Raise Rates?

Mark Thoma has a good post (with lots of good graphs) on the topic and discusses the continuing weakness in the U.S. economy.

The Whole Population, Employed, Unemployed & Underemployed

This chart from the Marketplace Whiteboard blog provides a good image of the scale of unemployment and underemployment to the whole population.

Health Care Break Down

Krugman has a good chart showing the sources of health care spending in the United States - a significant amount of American health care spending is already from the government - essentially, lots of Americans enjoy a single payer system.

Tuesday, January 25, 2011

State of Unemployment

Check out the interactive unemployment graph from Catherine Rampell.

Euro in the News

Two sources of views on the current Euro Crisis. First, Paul Krugman on the Euro from Fresh Air. Below is Paul Solman on the PBS News Hour:

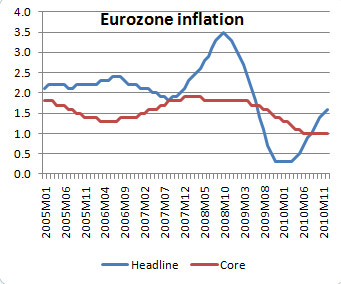

Eurozone Inflation - Choose your number

Sunday, January 23, 2011

Guide to the Phillips Curve

The Richmond Fed has a short guide to the Phillips Curve - great little teaching device.

Tuesday, January 11, 2011

Unemployment and Re-employment

The Wall Street Journal has a good article on how the unemployed are doing finding new jobs and the downward pressure on wages - the basic point is that wages are a lot less "sticky" in this recession. The graphs are illuminating.

Wednesday, January 5, 2011

Debtris Video

Information is beautiful has created a video on the size of different debts and prices for global problems that uses the idea of Tetris blocks to show scale - very cool and informative. Check it out.

Sunday, January 2, 2011

Mankiw's Advice for Obama

Greg Mankiw in the New York Times gives advice to Obama on how to deal with the Republicans in crafting economic policy. In the article he lays out the Republican view of economic philosophy. It is an interesting pieces, but I think it does more to give the ideas of traditional Republicans and not the Republican party in power now.

Saturday, January 1, 2011

Three Challenges to Macro

Ken Rogoff has published a proposal to the National Science Foundation "Grand Challenge" in economics. Rogoff's proposal highlights the three major challenges to macroeconomics following the economic crisis - basically, he nails it on the head.

Subscribe to:

Comments (Atom)